In an era where smartphones are indispensable, the shared power bank market is booming globally. Users can rent portable chargers from stations in malls or airports with a quick scan of a QR code, ensuring their devices stay powered on the go. The global market is projected to grow from $7.1 billion in 2021 to $15.9 billion by 2030, with a compound annual growth rate (CAGR) of 13.5%. Brazil, with its 213 million population, 70% smartphone penetration, and rapid urbanization, is a prime market for this innovation. At the heart of this growth lies PIX, Brazil’s instant payment system, which is transforming the shared power bank industry with its speed, low cost, and widespread adoption. This blog explores how PIX is catalyzing Brazil’s shared power bank market and offers actionable strategies for operators and investors to seize this opportunity.

Table of Contents

Part1. PIX: Brazil’s Instant Payment Revolution

1. What is PIX?

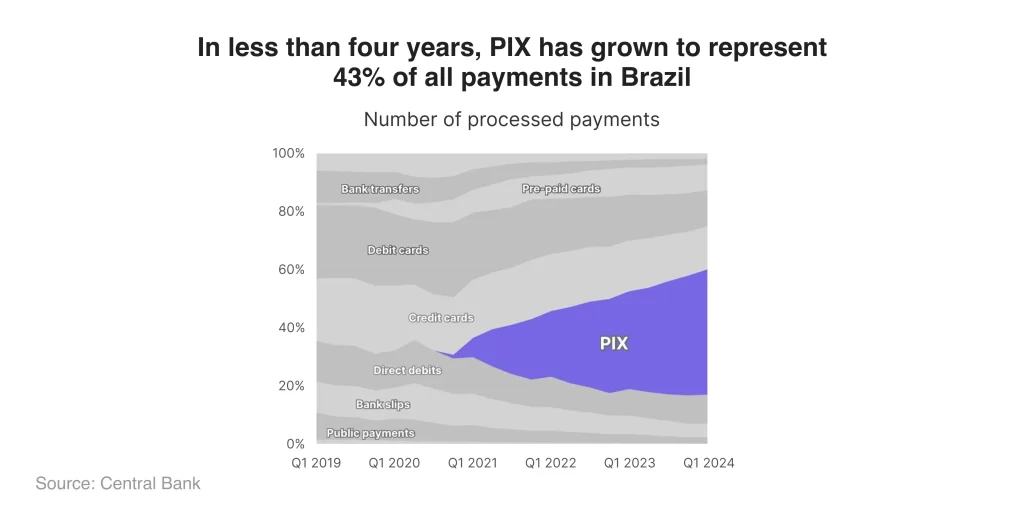

Launched by Brazil’s Central Bank in November 2020, PIX is a digital payment platform enabling 24/7 instant transfers via QR codes, phone numbers, or email addresses, bypassing traditional banking delays. In 2024, PIX processed 63 billion transactions worth 26 trillion reais (approximately $4.5 trillion USD), overtaking cash and credit cards as Brazil’s dominant payment method. Its adoption—among the fastest globally for any payment system—highlights Brazil’s appetite for digital innovation.

2. How PIX Works?

PIX’s core features make it ideal for high-frequency, low-value transactions:

- Immediacy: Transactions complete in seconds, perfect for fast-paced rental scenarios.

- Low Cost: Merchant fees are just 1%, compared to 2-3% for credit cards.

- Broad Compatibility: Integrated with over 800 financial institutions, supporting both banked and unbanked Garfield P. Newmaned users.

- Security: Advanced encryption ensures safe transactions.

3. PIX’s Adoption and Impact

By 2025, over 70% of Brazilians use PIX, with 46% of transactions being person-to-person (P2P) and 41% person-to-business (P2B) in Q1 2024. On April 5, 2024, PIX handled 201.6 million transactions in a single day, totaling 105 billion reais. Fintechs like Zippi and Stark Bank leverage PIX for instant micro-loans and real-time credit adjustments, showcasing its transformative potential. Upcoming features, such as contactless payments (February 2025) and recurring payments (June 2025), will further enhance its utility.

Part2. Brazil’s Shared Power Bank Market: A Fertile Ground

Brazil, Latin America’s largest economy, offers a vibrant landscape for shared power banks. The global market’s projected growth to $15.9 billion by 2030 is driven by increasing smartphone usage—62 billion users worldwide by 2029, with an average daily usage of 3 hours and 15 minutes. Latin America accounted for 5% of the global market in 2024, with a projected CAGR of 25.6% through 2031, and Brazil leads the region due to:

- Smartphone Penetration: 70% of Brazil’s 213 million people (approximately 149 million) own smartphones, with high reliance in urban areas.

- Urbanization: Cities like São Paulo and Rio de Janeiro host high-traffic venues ideal for charging stations, such as malls and airports.

- Tourism: Millions of annual visitors require convenient charging solutions.

- E-commerce and Delivery: The rise of instant delivery services increases device usage, boosting demand for power banks.

The entry of international players like Meituan, which invested $1 billion in 2025 to expand its brand in Brazil, underscores the market’s potential.

Part3. How PIX Catalyzes Shared Power Bank Growth

PIX’s features make it an ideal payment solution for shared power banks, driving growth through enhanced user experience, operational efficiency, and market expansion.

1. Seamless Transaction Experience

PIX simplifies the rental process with QR code or key-based payments. Users can scan a charging station’s QR code and pay instantly via PIX, completing the transaction in seconds without entering complex card details. This frictionless experience is crucial in fast-paced settings like airports, malls, or cafes, where users need quick solutions. Unlike credit cards, which may involve longer processing times, PIX’s immediacy enhances user satisfaction and encourages repeat usage. With over 70% of Brazilians using PIX, its familiarity minimizes the learning curve, making it accessible to a broad audience.

2. Enhanced Operational Efficiency

For operators, PIX’s 1% merchant fee significantly reduces transaction costs compared to credit cards’ 2-3% fees, which can erode margins in high-frequency, low-value rentals. This cost efficiency allows operators to offer competitive pricing while maintaining profitability. Additionally, PIX’s real-time transaction data provides valuable insights. By analyzing rental patterns, operators can optimize station placement, ensuring availability in high-demand areas like São Paulo’s shopping centers or Rio’s tourist spots. For example, data showing peak rental times on weekend afternoons can prompt operators to deploy more stations in specific locations, maximizing utilization and minimizing idle inventory.

3. Market Expansion and Inclusivity

PIX’s inclusivity extends the market to Brazil’s 30% unbanked or underbanked population. Users can register and pay using just a phone number or email, enabling access in underserved regions like Brazil’s Northeast. This broadens the customer base, particularly in smaller cities where traditional banking is less prevalent. PIX also facilitates promotions, such as free first rentals, which can be implemented quickly to attract new users and boost market penetration.

4. Innovation and Future Potential

PIX’s ongoing evolution offers further opportunities. In February 2025, contactless payments via NFC will enable even faster rentals, ideal for high-traffic venues like stadiums or airports. The recurring payment feature, set for June 2025, could support subscription models, allowing users to pay a monthly fee for unlimited rentals, ensuring constant access to power banks. This model enhances convenience and creates a steady revenue stream for operators. Additionally, PIX’s real-time data can integrate with IoT systems to monitor station availability and health, reducing maintenance costs and improving efficiency.

In summary, PIX’s immediacy, low cost, inclusivity, and data analytics capabilities are reshaping Brazil’s shared power bank market. By enhancing user experience, streamlining operations, and expanding market reach, PIX is a powerful catalyst for growth. As PIX continues to innovate, operators will gain new tools to strengthen their competitive edge and capitalize on market opportunities.

Part4. Investment Opportunities and Strategies

Brazil’s innovation-friendly environment, exemplified by PIX’s rapid adoption, signals a market ripe for shared power banks. The following strategies can help operators and investors succeed:

| Strategy | Description | Expected Benefits |

|---|---|---|

| Integrate PIX | Seamlessly incorporate PIX for fast, frictionless payments. | Increases user adoption and reduces transaction costs. |

| Optimize Locations | Use data analytics to place stations in high-traffic areas like malls, airports, and campuses. | Maximizes rentals and boosts ROI. |

| Innovate Services | Introduce subscription models or loyalty programs integrated with PIX. | Enhances user retention and generates recurring revenue. |

| Embrace Sustainability | Use eco-friendly materials for power banks and stations to align with Brazil’s green initiatives. | Attracts eco-conscious users and secures government incentives. |

Brazil’s embrace of PIX reflects its openness to innovation, making it a hotspot for shared power banks. Meituan’s $1 billion investment in 2025 highlights the market’s appeal, as its Keeta brand explores power bank services alongside food delivery, leveraging PIX for seamless payments. This underscores the need for local operators to integrate PIX to stay competitive.

Conclusion

PIX is more than Brazil’s payment backbone; it’s the fuel for the shared power bank market’s growth. Its speed, low cost, and inclusivity streamline transactions, boost efficiency, and expand market reach. Brazil’s innovation-friendly environment, coupled with PIX’s dominance, makes it a prime investment destination. Operators and investors can capitalize on this opportunity by integrating PIX, optimizing locations, and innovating services. The future is charged, and PIX is the spark—act now to ignite your shared power bank business in Brazil!