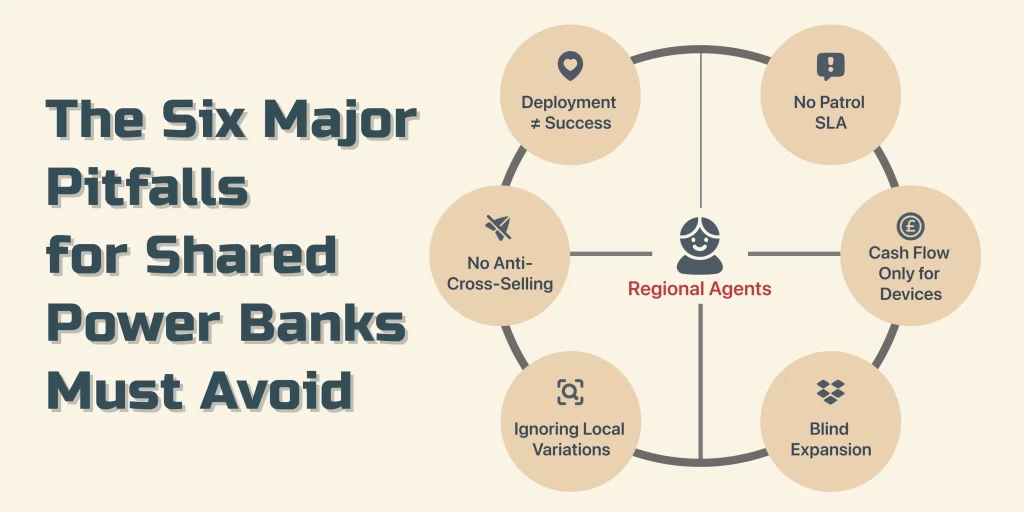

Table of Contents

- Introduction

- Pitfall 1: Treating “Device Deployment” as the End Goal While Ignoring Location Quality

- Pitfall 2: Lacking a “Patrol SLA,” Leading to Unattended Device Issues

- Pitfall 3: No Anti-Cross-Selling Mechanisms, Rendering Regional Agency Rights Meaningless

- Pitfall 4: Focusing Cash Flow Solely on Device Purchases, Overlooking Operational Costs

- Pitfall 5: Relying Exclusively on Headquarters Policies, Ignoring Local Variations

- Pitfall 6: Blind Expansion Leading to Unmanageable Operational Radii

- Conclusion

Introduction

At first glance, the shared power bank business may look simple: buy a few machines, place them in stores, let customers scan and borrow, and the revenue will follow.

That understanding might work for small shop owners, but once you sign on as a regional agent, what you’re taking on is not just the cost of devices—it’s the rights and responsibilities of operating an entire territory.

At this stage, the challenges are on a different level:

- How do you secure the best locations quickly, within limited time and budget?

- How do you make sure your team executes with consistent standards, rather than working in silos?

- And how do you protect the market space you’ve worked so hard to build?

If you find yourself asking these questions, then this article is written for you.

It won’t teach you “how to recover your cost with a few machines,” but rather how to avoid common pitfalls and navigate the real challenges of running a regional shared power bank operation.

Pitfall 1: Treating “Device Deployment” as the End Goal While Ignoring Location Quality

Many agents, upon receiving their devices, fall into “deployment anxiety”—rushing to place as many as possible to feel secure.

However, the outcome is often disappointing:

- Devices end up scattered in low-traffic spots, generating only single-digit daily orders;

- Merchants complain about minimal revenue, leading to waning interest;

- Your invested capital gets tied up indefinitely, with recovery seeming distant.

The Right Approach: It’s not about quantity but selecting “vital” locations that thrive.

Prioritize spots with steady foot traffic (e.g., malls, hospitals, transportation hubs), extended dwell times (e.g., restaurants, KTV lounges), and limited power access (e.g., bars, night markets).

Regularly review data to weed out underperforming sites monthly, ensuring your overall investment remains healthy and sustainable. This data-driven strategy can transform mediocre placements into high-yield assets.

Pitfall 2: Lacking a “Patrol SLA,” Leading to Unattended Device Issues

Shared power banks are essentially “self-service rentals,” and the biggest fear is devices breaking down without prompt attention.

Users encountering issues like non-charging batteries, stuck devices, or chronic shortages will erode repeat business and erode merchant trust.

This is why establishing a Patrol SLA (Service Level Agreement) is crucial. It sounds technical, but it’s straightforward:

- Patrol Frequency: Define how often checks occur (e.g., 1–2 times per week).

- Response Time: Set deadlines for fixes or restocking (e.g., within 24 hours).

- Availability Target: Aim for a minimum uptime rate (e.g., ≥95%).

Once these standards are in place, your team operates with clear guidelines, and merchants feel more confident in partnering with you. This not only boosts user satisfaction but also minimizes complaints and maximizes long-term partnerships.

Pitfall 3: No Anti-Cross-Selling Mechanisms, Rendering Regional Agency Rights Meaningless

You’ve paid for exclusive regional rights, only to have rival agents sneak in devices, siphoning your customer flow and partnerships.

Without robust safeguards from headquarters, your investment can be diluted overnight.

Solutions:

- Technical Measures: Bind device IDs to regions, use backend GPS tracking, and trigger automatic alerts for out-of-area placements.

- Management Measures: Enforce penalties like revenue freezes or device locks upon detecting violations.

By implementing these, the “territory” you’ve invested in truly becomes yours, protecting your market share and ensuring fair competition.

Pitfall 4: Focusing Cash Flow Solely on Device Purchases, Overlooking Operational Costs

Many agents calculate investments based on device costs and break-even timelines alone.

They forget ongoing expenses like team salaries, merchant commissions, patrol logistics, and equipment depreciation, which can drain cash flow rapidly.

Recommendations:

- Develop three financial models (optimistic, neutral, pessimistic) to simulate break-even periods under varying traffic scenarios.

- Secure at least 12 months of operational reserves to bridge the gap until profitability kicks in, preventing premature burnout.

This proactive planning helps anticipate hidden costs and builds a resilient financial foundation.

Pitfall 5: Relying Exclusively on Headquarters Policies, Ignoring Local Variations

Headquarters often rolls out uniform pricing and promotions, but regional markets differ vastly.

For instance, users in first-tier cities might accept a 3 yuan starting fee, while those in third- or fourth-tier cities balk at even 2 yuan.

Blindly adopting corporate rules can lead to market misalignment.

Best Practices:

- Maintain open communication with headquarters while advocating for “localized adaptations.”

- Experiment with joint promotions or membership bundles for flexibility, rather than unauthorized price cuts that risk penalties.

Tailoring strategies to local preferences can enhance user adoption and drive higher engagement.

Pitfall 6: Blind Expansion Leading to Unmanageable Operational Radii

Once profits appear on the books, many agents rush to scale: expanding from one district to the entire city, then neighboring areas.

However, larger radii inflate patrol distances, delay fault resolutions, and spike logistics and labor costs, eroding margins.

Advice:

- Start by perfecting a “high-density + high-efficiency” model in a core area.

- Validate with data before replicating elsewhere, ensuring scalable growth without overextension.

This measured approach fosters sustainable expansion and preserves profitability.

Conclusion

At its surface, the shared power bank business revolves around hardware, but success hinges on management expertise.

By steering clear of these pitfalls, you can transform your agency rights into a valuable asset rather than a liability. With strong operational discipline, data-driven decisions, and adaptive strategies, you’ll not only recover your investment but also build a thriving, scalable enterprise.