- The same machine earns hundreds per day in Store A, yet sits untouched in Store B. What’s the secret behind site selection? It all comes down to three key steps.

Have you ever faced this puzzle: identical shared power bank devices, but dramatically different outcomes depending on location? The truth is, the first and most decisive factor in this business is where you place your machines.

In the sharing economy, location determines everything. Unlike coffee shops or gyms, renting a power bank is an impulse-driven purchase. Users don’t plan ahead; they notice their phone battery is low and immediately search for the closest option. This means visibility, accessibility, and environment matter much more than brand recognition.

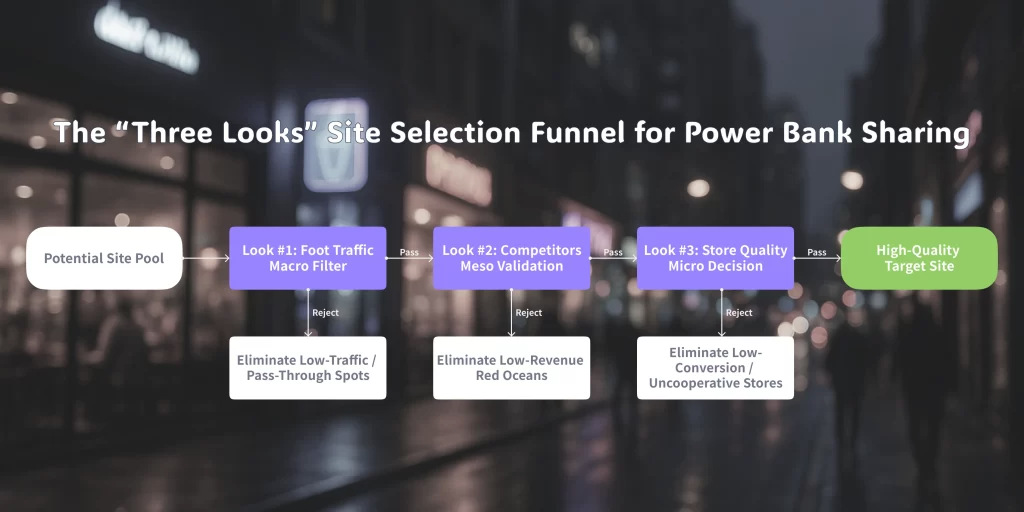

After years of field practice, experienced operators have distilled site selection into a clear and repeatable framework—the “Three Looks” principle. By evaluating foot traffic, competitor presence, and store quality, you can avoid costly mistakes and ensure every device you deploy has a high chance of success.

Table of Contents

Part 1. The Core Funnel of the “Three Looks” Principle

The diagram below illustrates how to filter potential sites step by step, narrowing down like a funnel until you find the best locations:

Now, let’s break down each layer of this funnel.

Part 2. First Look: Evaluate Foot Traffic

The first and most fundamental criterion is raw human flow. No matter how advanced your hardware or app, without people walking by, rentals simply won’t happen.

2.1 Why Foot Traffic Matters

Power bank rental is a need-based, opportunity-driven demand. Customers rarely leave home with the intention to rent a charger. Instead, they stumble upon a kiosk when their phone battery runs low. The more people who pass by, the more potential customers in that state of “battery anxiety.”

2.2 How to Spot High-Traffic Zones

1. City Hotspots: Business districts, shopping malls, pedestrian streets, nightlife areas, and transport hubs are natural crowd magnets.

2. Leverage Data Tools: Use heat maps from platforms like Baidu Maps, Google Maps, or location intelligence services. Red zones usually highlight the prime areas.

3. Check Temporal Variation: Don’t just look at total numbers. Offices peak during weekdays, bars and KTVs at night, and malls on weekends.

2.3 Pitfalls to Avoid

1. Mistaking Traffic for Conversions

- Example: Subway corridors have massive flows, but people are rushing.

- Solution: Prioritize venues where people linger—restaurants, cafés, waiting areas.

2. Accessibility Barriers

- Example: Mall atriums have huge crowds but property restrictions prevent placement.

- Solution: Secure management approval early. Otherwise, traffic means nothing to you.

Key takeaway: Foot traffic is your first filter—start broad, then narrow down.

Part 3. Second Look: Assess Competitors

Once you’ve identified high-traffic areas, the next step is checking where other operators (your competitors) have placed their machines.

3.1 Why Competitor Presence Matters

1. Identify Competitor Brands: Who dominates the city? National players like Energy Monster, Jiedian, or strong local operators?

2. Cabinet Size & Count: Pay attention to 12-port or 24-port cabinets. Large machines signal strong, stable demand. Smaller units may indicate trials or weak performance.

3. Revenue Benchmarks: Use monthly turnover as a reference point:

- ≥ $600/month: Golden site, worth full effort.

- $300–600/month: Moderate site, worth considering if rent/revenue share is favorable.

- ≤ $300/month: Risky site—likely unprofitable after costs.

3.2 Pitfalls to Avoid

1. Survivorship Bias

- Example: You only see surviving machines; many failed ones have been removed.

- Solution: Gather background info on the site’s rental history.

2. Blind Copying

- Example: Only entering competitor-heavy “red ocean” zones.

- Solution: Balance proven sites with emerging “blue ocean” opportunities.

Key takeaway: Competitor presence is your second filter. It validates demand and lowers risk, but don’t let it cage your strategy.

Part 4. Third Look: Examine Store Quality

After filtering for traffic and competitor signals, zoom into the micro level—the specific store, café, bar, or entertainment venue where you’ll actually place the device.

4.1 Why Store Quality Matters

Two venues with similar traffic can perform very differently. The deciding factors are customer dwell time, demographics, and charging scenarios.

4.2 Signs of a Strong Store

1. High Seating Capacity: Restaurants with many tables, KTVs with multiple rooms, or large cafés mean more potential renters.

2. Youthful Customer Base: Younger audiences (internet cafés, bubble tea shops, nightclubs) are heavier phone users and more QR-code savvy.

3. Long Dwell Time: Places like cafés, bars, and board game cafés encourage longer stays, increasing chances of mid-visit charging needs.

4. Extended Operating Hours: Venues open late at night—or 24/7—maximize earning windows and capture nighttime demand.

4.3 Red Flags (Instant Disqualifiers)

1. Uncooperative Owners: Staff who unplug machines or hide them.

2. Poor Network Signal: No connectivity means no rentals.

3. Unfair Contracts: Excessive revenue share demands (e.g., >70%) or short-term agreements that prevent ROI.

Key takeaway: Store quality is your final filter. It converts raw traffic into actual revenue.

Part 5. Take This Checklist on Your Next Site Visit

Foot Traffic (2 points)

1. Is traffic stable and sufficient during target hours?

2. Do people linger instead of just passing quickly?

Competitors (2 points)

1. Are competitors present with large machines (12/24 ports)?

2. Estimated monthly turnover above your profit threshold?

Store Quality (4 points)

1. Plenty of seats/tables, with average stays >30 minutes?

2. Young, phone-heavy customer base?

3. Device placement visible and accessible?

4. Store owner/staff cooperative?

Bonus (2 points)

1. Open late at night or 24/7?

2. Strong mobile network signal?

Scoring:

8+ points: High-quality site, secure it immediately.

6–7 points: Good site, worth trying and negotiating better terms.

≤ 5 points: High-risk, likely not worth it.

Conclusion

The secret to success in power bank sharing lies in being present the moment customers need you. The “Three Looks” principle—Look at Foot Traffic, Look at Competitors, Look at Stores— gives you a structured, repeatable way to find the best sites and spend your money wisely.

Think of it as a funnel: from macro to micro, from broad filtering to fine-tuned decisions. Combine this with the checklist and trial deployments, and you’ll steadily build a profitable, resilient charging network.

One-sentence summary: Go where the people are, let competitors prove the demand, and let store details decide your success.