Recently, the journey of a leading shared power bank brand—from going public to strategic realignment—has sparked in-depth reflection both inside and outside the industry. This is not merely a tale of success or failure, but rather a pivotal turning point where the entire sector transitions from rapid expansion to refined operations and the pursuit of sustainable business models. The experiences and lessons from this case offer valuable insights for all industry players.

Table of Contents

Part 1. Post-Expansion Challenges: Rebalancing Efficiency and Experience

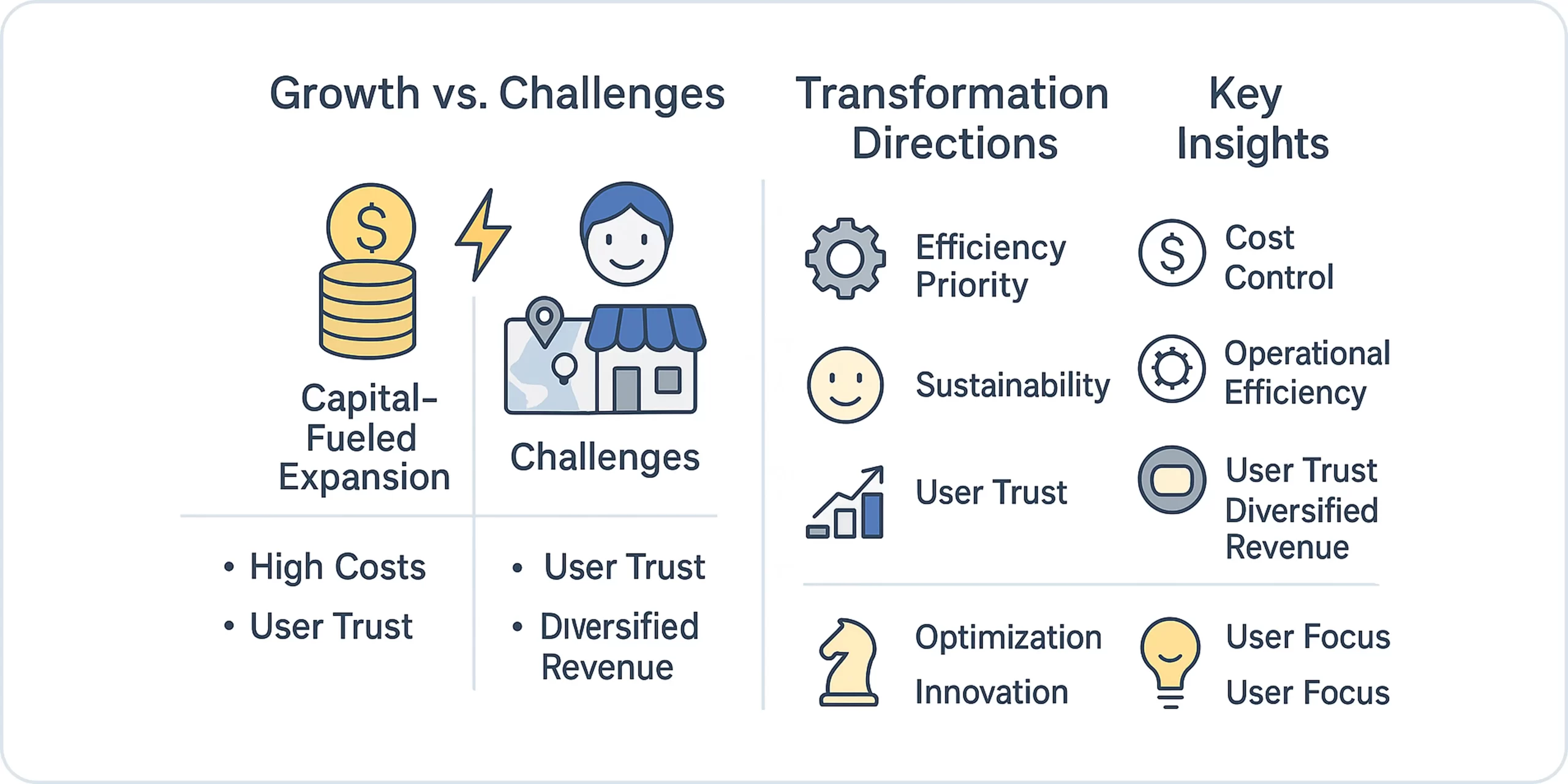

In its early stages, this top brand capitalized on strong financial backing to scale rapidly and seize prime locations, becoming a market leader. However, as the external environment evolved, its development trajectory highlighted the deeper, structural issues shared across the industry:

1.1 Mounting Pressure on Cost Structures

The Price of Location Dominance: To secure premium venue placements—such as high-traffic restaurants and shopping centers—brands have had to offer merchants steep entry fees or revenue-sharing terms, sometimes eating into 40–60% of every transaction. This has significantly eroded actual profit margins.

Ongoing Operational & Maintenance Costs: A large-scale deployment of devices results in a heavy burden of depreciation, maintenance, logistics, and manpower expenses. As the network grows, these costs become increasingly difficult to offset.

Rising User Acquisition Costs: With intensified competition and fading novelty, platforms must invest more in subsidies, advertising, and promotions to attract new users and retain existing ones, driving up customer acquisition costs.

1.2 Trust and Experience Under Strain

Pricing Sensitivity Thresholds: In order to cover operational expenses, some platforms have raised prices in certain regions or during peak times—sometimes reaching 6–10 RMB per hour, or daily caps of 30–60 RMB. This exceeds users’ psychological pricing expectations and deters repeat usage.

The “Return Difficulty” Problem: Users often report issues such as fully occupied return slots or system glitches during the return process, resulting in failed returns or unexpected charges. These negative experiences weaken trust.

Transparency and Convenience Gaps: Lack of clarity in billing rules, difficulties in locating stations, and non-intuitive return procedures still plague some services, highlighting areas in need of urgent improvement.

Part 2. Positive Industry Transformations and Strategic Directions

In response to these challenges, leading enterprises are now actively pursuing strategic transformation. Their ongoing exploration provides a valuable blueprint for the broader industry:

2.1 Optimizing Operations to Improve Efficiency

Adopting Flexible Collaboration Models: Some brands are shifting from fully self-operated models to hybrid ones involving local partners or agents. This approach reduces capital and operational burdens by distributing localized responsibilities. The key to success lies in establishing standardized service and management protocols to maintain a consistent user experience.

Refined, Data-Driven Operations: Leveraging analytics to identify high-value locations and customer segments enables smarter device deployment and dynamic pricing strategies. For instance, focusing on high-traffic, long-dwell-time venues like hospitals and transit hubs can yield higher returns. Tailoring pricing based on time and location helps strike a balance between affordability and profitability.

2.2 Expanding Beyond Charging to Unlock New Value

Enhancing Location-Based Services: Shared power bank stations are not just charging units—they are potential offline traffic gateways. By embedding targeted ads or local service information on station screens or within the app interface, platforms can open new revenue streams beyond rentals. Early adopters have already seen positive results in this area.

Cross-Business Integration: With access to large user bases and dense physical networks, some brands are exploring collaborations with lifestyle services, loyalty programs, or even retail products. This creates opportunities for cross-selling, increasing both per-user value and per-location revenue output.

2.3 Technology as a Catalyst for Experience Upgrades

Improving Hardware and System Reliability: Investment in durable, faster-charging devices with universal port support, alongside backend optimization to minimize errors and ensure smooth returns, addresses core user pain points.

Smarter Device Management: IoT-powered real-time monitoring of device status (e.g., battery levels, slot availability) combined with predictive maintenance helps cut costs. Big data analytics can also guide strategic decisions and enhance the precision of marketing and deployment.

Part 3. Key Lessons: Returning to Fundamentals, Growing Through Value

The experience of leading brands—and the broader wave of transformation—offer several takeaways for the industry at large:

Sustainability Over Short-Term Scale: The old model of scaling through aggressive capital infusion and location hoarding is running out of steam. Future competitiveness lies in the profitability per location and a healthy cash flow cycle. Precision and efficiency now matter more than raw expansion.

User Experience Is the Lifeline: Pricing strategy, device usability, return convenience, and issue resolution speed all shape the user journey. Any erosion of trust—be it hidden charges or faulty returns—will ultimately damage brand equity and industry credibility. Building a transparent, reliable, and frictionless user experience is non-negotiable.

Cost Control and Efficiency Are Survival Priorities: The industry must confront and structurally optimize high costs, particularly for venues and operations. This calls for innovation in business models (e.g., agent partnerships), technology adoption (e.g., intelligent O&M), and operational precision (e.g., data-driven decisions).

Unlocking Diversified Value Creation: As a frequent-use, high-demand offline touchpoint, the shared power bank station’s value extends beyond just “charging.” Unlocking adjacent monetization channels—such as advertising, data services, and ecosystem integration—is essential for building a resilient business model.

Technology Is the Long-Term Competitive Moat: Continuous investment in device innovation, backend infrastructure, and data capabilities not only enhances operational performance but also creates product differentiation and improves user satisfaction.

Conclusion: Toward a Healthier, More Sustainable Future

The shared power bank industry has moved beyond its initial boom and now stands at a crossroads of deep operational refinement, value innovation, and sustainable growth. The journey of the leading brand reflects broader industry shifts, underscoring the importance of efficiency, user trust, and resilient business models.

While challenges persist, the fundamental need for on-the-go mobile charging remains unchanged. In fact, with the proliferation of 5G and smart devices, this demand is only becoming more entrenched. The real question is whether industry players can:

- Truly prioritize the user experience and rebuild long-term trust;

- Restructure their cost models to ensure operational sustainability;

- Boldly pursue innovation beyond the rental model and tap into broader ecosystem value;

- Continue investing in technology to drive efficiency and deliver superior service.

This path won’t be easy—but it is necessary. The companies that embrace this transformation—those who focus on user needs, optimize for efficiency, and commit to long-term innovation—will lead the next era of the shared power bank industry, ushering in a future that is healthier, more sustainable, and full of promise.