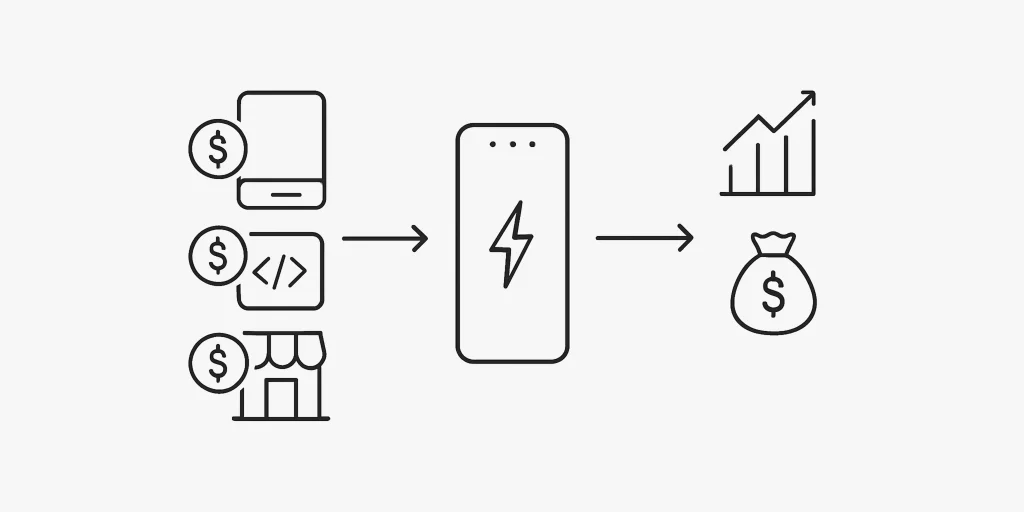

When evaluating a power bank rental business, many operators focus solely on revenue growth—how many rentals per day, how fast units are being deployed. But here’s the critical question: Are you actually making a profit per unit?

Understanding unit economics—the financials behind each rental device—is the key to long-term sustainability in the shared power bank business. In this article, we’ll break down how to calculate profitability per unit, analyze cost and revenue structures, and offer actionable tips to improve your margins.

Table of Contents

- Part 1. Why Unit Economics Matter More Than Total Revenue

- Part 2. Cost Structure Breakdown: Where Does the Money Go?

- Part 3. Revenue Model and User Behavior Insights

- Part 4. Break-Even Calculation: Are You Covering Your Costs?

- Part 5. Strategies to Improve Unit-Level Profitability

- Conclusion: Focus on Profit per Unit, Not Just Total Scale

Part 1. Why Unit Economics Matter More Than Total Revenue

In high-volume rental businesses, it’s easy to confuse high transaction volume with profitability. But volume without margin leads to fragile operations. Instead of asking, “How much are we earning each month?”, savvy operators ask, “How much are we earning from each deployed unit over its lifetime?”

Unit economics helps you answer:

- How many months until I recover my investment in each device?

- How much profit does a single unit generate over its lifespan?

- Which locations, pricing models, and user segments are actually profitable?

Part 2. Cost Structure Breakdown: Where Does the Money Go?

Before calculating profit, let’s understand the cost components of a single power bank rental unit.

Initial Investment Costs

- Device procurement: Depending on supplier and features, units range from $30–$80.

- Software or platform fees: For app integration, backend support, and analytics.

- Location setup costs: Signage, initial coordination, possible placement fees.

Operating Costs

- Venue fees: Revenue-sharing (commonly 20–40%) or flat monthly rent per location.

- Maintenance and logistics: Device retrieval, repairs, replacement parts.

- Electricity and connectivity: Especially if using SIM cards or IoT monitoring.

- Customer service support: Staff or outsourced response to rental issues or refunds.

Hidden Costs

- Marketing and incentives: Coupons, first-rental discounts, referral rewards.

- Depreciation: A device used daily will eventually need replacement—usually after 18–24 months.

Part 3. Revenue Model and User Behavior Insights

Revenue comes from each successful rental, but it’s driven by user patterns:

Rental Frequency

- High-traffic locations (airports, malls, nightclubs) drive multiple rentals per day.

- Low-traffic or less urgent venues (cafes, salons) may only see a few per week.

Income Per Rental

- Rates vary by region: common pricing is $1–$2 per hour, with capped daily rates.

- Average revenue per unit = (Daily rentals) × (Average rental value)

User Lifetime Value vs. Acquisition Cost

- Returning users drive steady profit; one-time users are expensive.

- Promotion-heavy acquisition must be balanced by retention efforts.

Part 4. Break-Even Calculation: Are You Covering Your Costs?

Basic Formula:

- Break-even time (months) = Initial investment / Monthly profit per unit

Let’s break it down with a sample scenario:

| Metric | Value |

|---|---|

| Device cost | $50 |

| Revenue per day | $3 (e.g., 3 rentals × $1) |

| Monthly revenue | ~$90 |

| Operating cost/month | $30 (rent + logistics + service) |

| Monthly net income | $60 |

- Break-even time = $50 / $60 ≈ 0.83 months → less than 1 month

Of course, lower traffic or higher operating costs extend the break-even period. A realistic average in medium-traffic locations is 6–8 months.

Part 5. Strategies to Improve Unit-Level Profitability

Maximizing profitability per unit isn’t just about cutting costs—it’s about optimizing performance across the board.

1. Increase Rental Frequency

- Prioritize high-urgency zones: transportation hubs, shopping centers, nightlife districts.

- Build dense deployment clusters to improve visibility and convenience.

2. Refine Pricing Strategy

- Test per-minute, hourly, and capped rates.

- Consider premium pricing in airports or tourist areas.

- Offer member pricing or bundles to increase user loyalty.

3. Lower Operating Costs

- Automate maintenance alerts using IoT sensors.

- Negotiate better venue terms or switch from rent to revenue-share.

- Invest in durable devices to reduce replacements.

4. Boost User Retention

- Simplify rental/return process with well-designed apps.

- Use gamification or loyalty points to encourage repeat usage.

- Offer incentives for users to rent again from nearby locations.

Conclusion: Focus on Profit per Unit, Not Just Total Scale

The power bank rental industry can be profitable—but only if each unit is pulling its weight. Without solid unit economics, scaling too fast can actually increase losses.

By thoroughly understanding your costs, monitoring rental behavior, and adjusting pricing and placement, you can build a profitable and sustainable rental network—one unit at a time.