Table of Contents

As mobile devices continue to be indispensable in daily life, the demand for on-the-go charging solutions keeps rising. Shared power bank services, which allow users to rent portable chargers in public and commercial spaces, have expanded in line with growing smartphone usage, digital payments, and urban mobility. This article reviews the historical development of the market, analyzes the current 2025 landscape, projects trends for 2026, and offers guidance for new entrants and existing operators.

Part 1. Historical Market Trends (2023–2024)

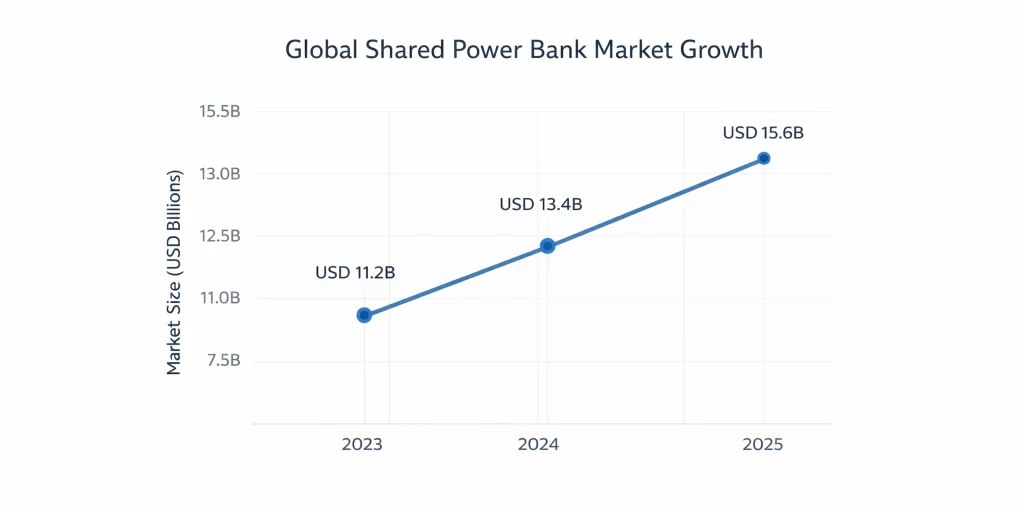

In 2023, the global shared power bank market stood at approximately USD 11.2 billion, reflecting the early adoption of shared charging services in transit hubs, shopping malls, and other high-traffic locations (GlobalMarketStatistics).

In 2024, the market reached around USD 13.4 billion, as deployment density increased and user adoption became more mainstream (GlobalMarketStatistics).

The shared power bank rental segment—consumer-facing, pay-per-use services—also grew steadily:

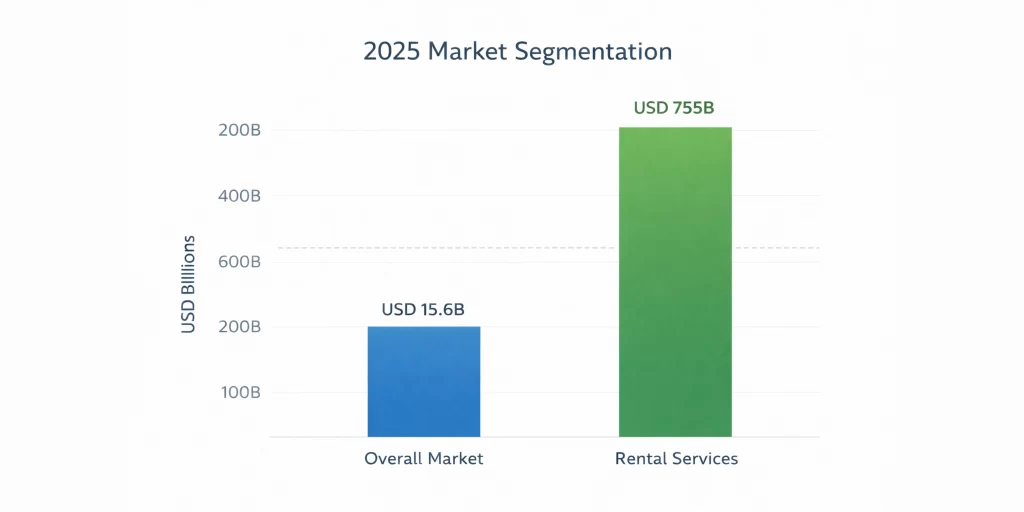

In 2024, rental services totaled approximately USD 690 billion, driven by the increasing use of app-based and QR-code rental models (Stats Market Research).

Part 2. Current Market Status (2025)

By 2025, the global shared power bank market reached USD 15.6 billion, with rental services totaling USD 755 billion, reflecting continued steady growth (GlobalMarketStatistics).

Key Characteristics in 2025

- Deployment Venues: Transit hubs, malls, restaurants, cafés, event spaces, and campuses.

- Technology Adoption: QR-code rentals, app integration, mobile wallet payments, and fast-charging capabilities have become standard.

- Regional Leadership: The Asia-Pacific region holds the largest market share due to high population density, widespread smartphone use, and mature digital payment infrastructure (CoherentMarketInsights).

Part 3. Market Outlook (2026)

The market is projected to grow steadily throughout 2026, continuing its established upward trajectory without abrupt acceleration or slowdown (GlobalMarketStatistics).

Rental services are expected to remain the primary growth driver, supported by smartphone ubiquity and user preference for convenient, app-integrated charging solutions (Stats Market Research).

Key Growth Drivers:

1. Widespread deployment across commercial and public venues.

2. Seamless user experience via QR-based rentals and digital payments.

3. Continued urban mobility and reliance on mobile devices.

Part 4. Market Drivers & Dynamics

Smartphone Penetration: Nearly 7 billion devices in use globally, sustaining baseline demand for portable charging (Stats Market Research).

High-Footfall Locations: Dense foot traffic in malls, transit hubs, and entertainment venues encourages repeated usage.

Technology Integration: App-based rentals, IoT-enabled kiosks, and real-time monitoring improve service reliability and operational efficiency.

Part 5. Practical Guidance

5.1 For Businesses Considering Entry

1. Form Strategic Partnerships: Focus on high-traffic locations under revenue-sharing or lease agreements to reduce upfront investment and risk.

2. Prioritize User Experience: Ensure smooth, contactless rental and return processes via integrated apps to drive adoption.

3. Diversify Deployment: Explore retail stores, event venues, and campuses where episodic but frequent charging demand exists.

5.2 For Current Operators

1. Optimize Existing Networks: Focus on improving utilization rates at current locations before expanding geographically.

2. Leverage Data Analytics: Use usage insights to optimize placement, inventory management, and dynamic pricing.

3. Diversify Revenue Streams: Introduce advertising, loyalty programs, or premium subscriptions to increase per-location value.

4. Ensure Service Reliability: Maintain high uptime, consistent charging performance, and responsive customer support as key competitive advantages.

Summary

Historical Growth (2023–2025): The market grew steadily from USD 112 billion in 2023 to USD 156 billion in 2025, while the rental segment expanded from USD 690 billion to USD 755 billion.

2025 Status: A mature market with strong adoption in high-traffic areas and clear leadership in the Asia-Pacific region.

2026 Outlook: Continued moderate growth driven by user behavior, urban density, and seamless digital integration.

Strategic Focus: New entrants should emphasize partnerships and UX, while existing operators should optimize operations and explore ancillary revenue models.